Cover Photo by bruce mars on Unsplash

Something I just noticed today and thought it would be worth sitting down and writing out a brief post about it. I wanted to share this since it’s a pretty important bit of information for anyone just getting into trading stocks.

If you’re a Robinhood trader, you should be aware that Robinhood includes deposits as part of the portfolio returns they report within the app, and the website. This means that they are reporting returns using a Simple Rate of Return:

BMV = Beginning Market Value

This is bad for two reasons:

A) It’s not an actual measure of trader performance

B) It can vastly overstate returns, as well as vastly understate returns depending on your deposit strategy.

C) It can underreport the impacts of large market swings, and how you’ve done in the interim.

Simple Rate of Return is just that, very simple to calculate. It’s generally used to track indices and things where inflows and outflows of cash are not important to track for performance reasons. You’re only seeing a very simple view of performance with an SRR.

Another way to calculate returns is to use an IRR (Internal Rate of Return).

DtDRG = Date to Date Realized Gains

DV = Dividends

Int = Interest

PA = Purchase of Accrued Interest (For Bonds)

SA = Sale of Accrued Interest (For Bonds)

∆ai = The change in accrued interest from the beginning of period to end of period

MaxFees = Remove any fees paid (commissions) during the period. This is optional but recommended

BMV = Beginning Market Value

⅀Cashflows = This is the sum of all cashflows for the period

(di/td) = Date of Flow over days in period ( IE if a $200 flow happens on the 15th of November h, it would be 200*(15/30) )

The nice thing about an IRR is that it does include the size, and timing of cash flows to create a more specific and useful measure of portfolio return. However while it accounts for them, IRR still includes the cashflows of a portfolio in the calculations, so these can skew your overall measure of how good your trading strategy is doing.

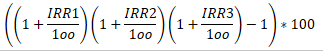

The last and most complex measure of performance that I’ll cover here is the TWR (Time Weighted Return)

While it seems like it’s more simple than the others, the TWR includes all of the accounting for the IRRs, and chains them together into a return stream to offset for the individual flow based IRRs. By doing this it’s removing the effect of the cash flows in the portfolio and actually focuses in on the actual performance of the investments in the portfolio rather than the cash movement muddying it up.

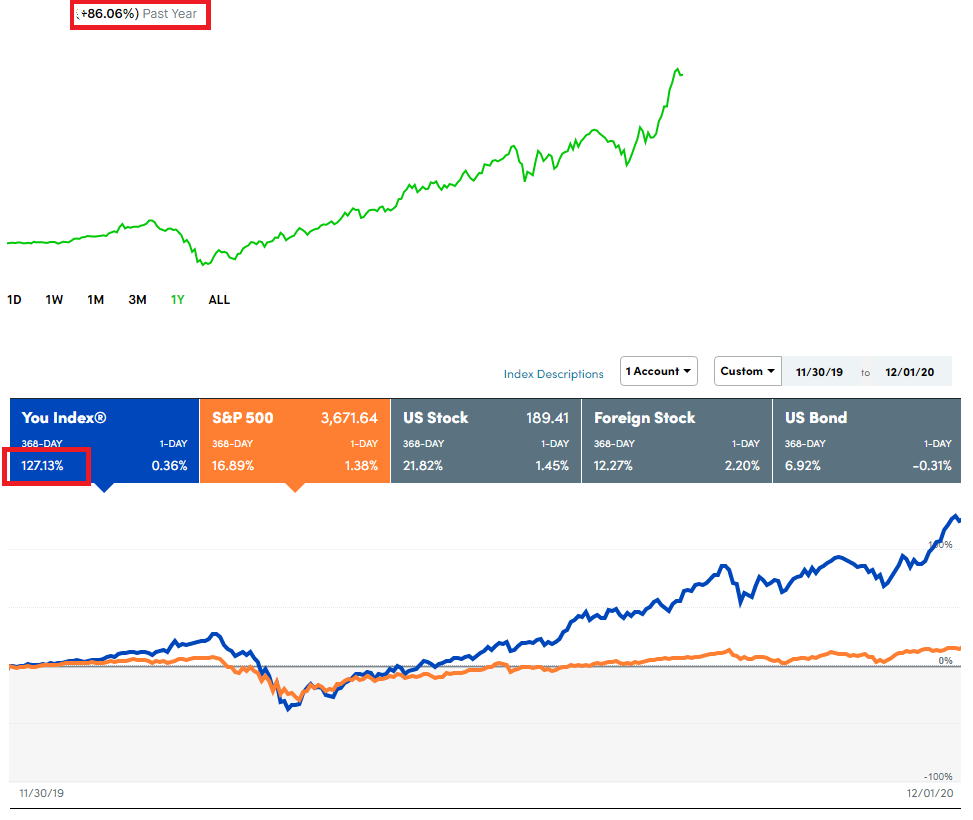

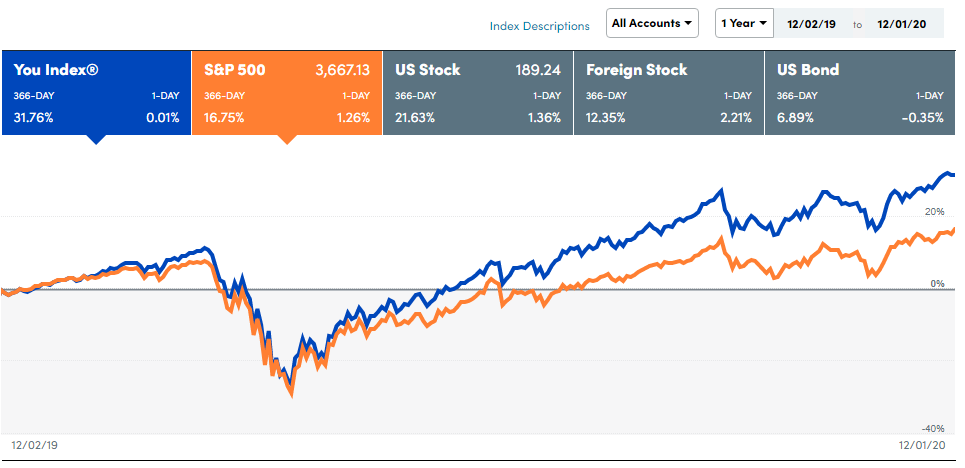

For my deposit strategy I tend to do big chunks here and there, and am not regularly adding to my Robinhood account until I have a purchase I want to make. Because of this the Robinhood SRR under-reports my returns. If you are following good financial advice and adding a bit every month, this would greatly inflate your RH returns as it wont account for market movement very well. It’s important to track your real performance so you can measure the effect of different strategies. I tend to use different brokerages to track different strategies because I can break up the performance by account. Some trading platforms allow you to break up the accounts within the platform as well, which is also helpful. Example from my own account. First graph is RH, second graph is from PersonalCapital (Which does a Time Weighted Return, if you use my link to sign up for an account we both get $20)

I really like PersonalCapital because I can pull all my investment accounts into one place, and report on performance in a unified manner. I have upwards of 13 financial accounts loaded to it right now and I get to see everything on one dashboard which is amazing.

I love being able to report on individual accounts as well as the mix so I can see how my overall plan performs against the market as a whole. If you’re serious about investing and growing your wealth, I cannot recommend PersonalCapital enough.

You must be logged in to post a comment.